The U.S. government has set ambitious goals for the production of energy from offshore wind turbines. The challenge will be creating the infrastructure— in job skills and equipment—to meet the demand.

By Warren Miller, Marine Construction Magazine

The Spanish city of Bilbao is at the corner of the Bay of Biscay, where France and Spain meet on the Atlantic coast. It’s a beautiful, windswept spot— the perfect location for an annual conference on the production of offshore wind.

The occasion was the 2022 meeting of WindEurope, a conference attended by major players in offshore wind energy from Europe and the U.S. One of the sponsors of WindEurope 2022 was Iberdrola, a company based in Bilbao whose U.S. subsidiary AVANGRID is listed on the NYSE and has more than 8,000 megawatts (MW) of installed capacity. AVANGRID recently began developing Vineyard Wind One, the first large offshore wind farm in the country, which will produce 800 MW. AVANGRID also has started the permitting process with the U.S. Department of the Interior’s Bureau of Ocean Energy Management (BOEM) for its Kitty Hawk North project, off North Carolina’s Outer Banks, which will produce an additional 800 MW.

Those projects—and many others—will need to come online to fulfill the goal set by the Biden administration of 30 gigawatts (GW) of power by 2030. Today, turbines off the U.S. coast produce only 0.042 GW.

Jeff Andreini, Vice President of Crowley New Energy, a new division of Crowley, a global maritime and logistics company, was in Bilbao for the conference and to visit some of the companies in the forefront of development of offshore wind energy. And though the production of energy from offshore wind turbines is more advanced in western Europe than in America, the industry is rapidly gaining traction in the U.S. The dramatic increase in the production of energy from offshore wind turbines is not a prediction. Offshore wind energy isn’t a technology of the future. It’s here. And it’s taking off.

“We have only two offshore wind projects in operation today,” Andreini says, “wind farms off of Block Island (R.I.) and off the Virginia coast. But contracts have been signed for projects that will start construction in 2023, and many more will begin in the years following.”

Block Island Wind Farm was the first commercial offshore wind farm in the United States, located 3.8 miles from Block Island, R.I. in the Atlantic Ocean. The five-turbine, 30-MW project was developed by Deepwater Wind, which now is Ørsted U.S. Offshore Wind and affiliated with Ørsted, a Danish firm. Construction started in 2015 and operations began in December 2016.

The Coastal Virginia Offshore Wind (CVOW) Pilot, a pilot project of Dominion Energy and the state, includes two 6-megawatt turbines in 2,135 acres of federally owned waters 27 miles off the coast of Virginia. Both turbines generate 12 MW and power 3,000 homes at peak wind speeds. The project was completed in 2020 and cost $300 million.

Jacksonville, Fla.-based Crowley and its New Energy division are working to become central support players in the new industry. Best known for its end-to-end services and vessels in the maritime industry and government, the company is sending a strong signal of commitment to the burgeoning offshore wind industry by creating the new division and basing it in Providence, R.I.

“From our standpoint, it’s real and it’s happening now,” Andreini says. “Hopefully, we’ll see revenues in 2023, and a significant increase in activity throughout the industry beginning in 2025, the real starting point for much of the work now in contract negotiations.”

An example of that work is the Wind Energy Area in the New York Bight— an area of shallow water between Long Island and the New Jersey coast—that was announced recently by the Interior Department’s BOEM. An economic impact study by consulting firm Wood Mackenzie indicates that the Wind Energy Area could support up to 25,000 development and construction jobs from 2022 to 2030, as well as an additional 7,000 jobs in communities supported by this development. The study states that the New York Bight lease area also has the potential to support up to 4,000 operation and maintenance jobs annually, and approximately 2,000 community jobs, in the years following.

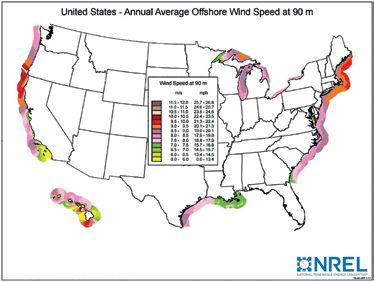

From Maine to Virginia, along the Gulf Coast and the Pacific Northwest, projects are lining up for private and government investment. But while the potential benefits are large and widespread, the challenges are substantial, as well.

The critical resources now in short supply aren’t dollars. They’re Jones Act-compliant vessels, industry- specific equipment, and above all, a trained work force for onshore and offshore activities in offshore energy production.

“It’s going to be challenging, no doubt,” Andreini says. “We are definitely short on assets right now. There are only 13 barges available to service the feedering of wind projects in the United States. There’s an absence of heavy horsepower tug boats to bring out the barge and assist in the installation of the turbines.”

The most critical need, though, is the development of a workforce. The demand outstrips the available labor pool for mariners and technicians who are trained in the construction, operations and maintenance of the offshore turbines, as well as the onshore operations of terminals and their IT, logistics and vessels.

Crowley recently announced that it is partnering with the Massachusetts Maritime Academy (MMA) to train workers for offshore energy production.

Gulf coasts of the U.S. have promising wind resources for

energy production.

“We as a company are putting a lot of our efforts in developing those workforces in each of the states where we’re doing business,” Andreini explains. “MMA is already a model, and we’ll be making another major announcement shortly, plus two more schools in the Mid-Atlantic that we’ll announce in the second quarter of 2023. And we’re not just involved in the training but in developing the curriculum, as well.”

“Plenty of people are coming from O&G to support offshore wind,” Andreini says. “The transition, while not seamless, shouldn’t be difficult. The contracting, though, is going to be a huge change from what we are used to. Having gone through three contracts with major wind energy developers, we’ve learned that it’s a bit of a paradigm shift. How we do business with European developers, how we partner with companies. It’s not a hurdle that we can’t overcome, but it’s a new challenge. We’ve already had significant lessons learned.”

As any motivational expert will tell you, challenges and opportunities are two sides of the same coin. Energy production from offshore wind turbines is a market that is certain to have a major impact on the marine construction industry.

“This is real and it’s happening,” Andreini says. “It’s time to get on board or you will be left at the station. By 2025, the work is going to be like a tidal wave coming over this entire nation. We’re not prepared for it now, but my hope is once people hear that a company like Crowley has signed contracts, it’s going to be a green light for others to make the investment to be competitive in this space. We need more companies competing for the contracts. There will be a lot of contracts.”

Republished from Marine Construction Magazine Issue V, 2022